One of the first deals ever done with Firmex was a bankruptcy filing. I spent several hours going through how this particular law firm used Firmex to manage the process. Here is a summary of that conversation.

The Problem: Distributing Confidential Documents Using Email, Mail and Fax in a Complex Working Group

The burden of managing this document intensive exercise for a distressed company is enormous. Gathering, tracking and distributing this information via email or mail is cumbersome, expensive and prone to error. It also effects everyone involved and often results in bottlenecks throughout the process.

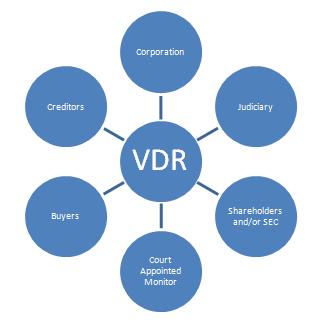

Common Participants in a Restructuring Working Group and Their Responsibilities

Corporate Managers and Employees: Corporate managers and employees are required to gather and distribute information to various stakeholders.

Creditors: Senior secured lenders require ongoing operational information such as weekly receivables reports as per their debt covenants. Junior lenders have a different scope of reporting requirements. Unsecured vendors have their own set of rights to information. The DIP (Debtor-in-Possession) lender also requires its own separate set of reports.

Shareholders and SEC: Shareholders need to receive updates, and if the company is public, additional disclosure is required by the SEC or equivalent.

Buyers: Potential buyers of the business assets require access to diligence information and the ability to negotiate purchase agreements.

Court Appointment Monitor: The court appointed monitor requires full disclosure throughout the entire process.

Judiciary: The Insolvency judge’s decisions and court documents need to be distributed.

The Solution: Centralized Secure Document Access and Distribution

Firmex Virtual Data Rooms are designed to have the flexibility to streamline and manage the various requirements of a restructuring process. The following describes how a Firmex client managed a recent insolvency.

Information Assembly and Distribution to Various Stakeholders

By giving stakeholders predefined access rights to a private-labeled virtual data room, with the ability to review information on an ongoing basis, the administrative burden on the client was dramatically reduced. Furthermore, 24/7 access and automated notification kept stakeholders well informed with minimal extra cost to the client.

Corporate Client: Corporate staff is able to upload ongoing financial and operational information while at their desks in various office locations. Senior personnel would then vet the information online, before releasing it to outside stakeholders.

Creditors: Various creditors were able to access reports and sign-off on releases in the law firm’s virtual data room.

DIP Lender: Debtor in Possession documents included negotiated and finalized agreements managed in the virtual data room.

Court Appointed Monitor: The appointed court monitor had a comprehensive view of the proceedings and posted its weekly reports for authorized access online.

Court Orders: All relevant litigation documents were posted in Firmex.

Sale Process: Online Due Diligence enabled the auctioning off of the corporation’s assets to multiple bidders. Definitive asset purchase agreements, related schedules, creditor consents and approvals were all negotiated and executed through the virtual data room.

Closing Deliveries: All closing documents and conditions were negotiated and executed in Firmex.

Post-Closing Matters: Post-closing matters, including articles of amendment, resignation letters, distribution of the proceeds of sale and other post-closing filings, were also managed in the virtual data room.

Summary

With access to a Firmex Virtual Data Room, the law firm relieved their client of cumbersome and time consuming communication and information assembly processes. Using a facility accessible 24/7 for managed document access made the entire process -easier, faster and cleaner. By having a virtual data room to facilitate the transaction, the law firm provided an enhanced caliber of service for its client.